Last Updated: Feb 2025

If you are planning to shop in Korea (as you should!) you definitely want to take advantage of tax refund shopping! However, if it's your first time shopping in Korea, you may be a bit confused about what duty free and tax free shopping is, and how you should file a tax return. Don't worry, we have prepared an in-depth guide on how to shop tax-free and the best way to get a tax refund in Korea!

Need to exchange money for your upcoming trip? Use our Currency Exchange Service for easy exchange with the best rates right at the airport!

Korea's Tax Free System

There are three main ways to obtain a tax refund in South Korea; duty free, as a post-purchase refund, or as an on-site refund. A more in-depth explanation is provided in the list below.

1. Duty-Free (In-advance tax exemption): This is when you make a tax-free purchase at a designated duty free shop.

VAT, individual consumption tax, tobacco consumption tax and liquor tax are all exempted. The advance duty free shop is characterized by being able to purchase goods coming abroad at low prices. These stores are usually large department stores such as Shinsegae Department Store, Shilla Department Store, and Lotte Department Store.

They are usually located at the airport and downtown areas. Tourists can purchase goods at a low price with proof of a flight that leaves the country! For more info on department stores, click here.

- Duty-Free Purchase Limit: $800 USD

*Liquor and perfumes can be purchased in addition and have a separate tax exemption range.

2. Immediate Tax Refund: This is when you make a purchase at a store that offers immediate tax deductions.

Tourists can easily and immediately get a tax-free refund within a certain limit when they shop at a certified tax free store.

3. Post-Purchase Tax Refund: This is when you pay full price at the time of purchase and later apply for a tax refund.

This is the most common tax refund system in South Korea, in which shoppers purchase products at the full price including tax and receive a refund of the tax paid before leaving the country. When making a purchase at a store and meeting the minimum purchase requirement, you will receive a tax refund receipt after presenting your passport.

Only VAT and individual consumption tax are exempted. (This does not include customs duties, tobacco consumption tax, and liquor tax.) In general, you can receive a tax refund by showing the receipt (refund slip) at the tax refund booth upon departure.

- Minimum Purchase Amount for Tax Refund: 15,000 KRW per item

Need to book beauty services at a Korean skincare clinic or hair salon? Check out the spots below to easily book appointments with special discounts!

1. Duty Free

The tax imposed by the duty free shop is a duty on imports and does not apply to travelers. Therefore, you do not have to worry about products sold at major duty-free downtown department stores or airport duty free shops as the price does not include tax.

Q: What is the purchase limit at duty-free stores?

A: Foreign travelers can purchase up to $800 USD at the duty free shop. In addition to the applicable duty-free limit, alcohol and perfume can be purchased within a separate duty-free range.

Q: What is the purchase limit on alcohol, perfumes, and cigarettes?

A: If you have already met the $800 USD duty-free limit, you can still buy alcohol, perfume, and cigarettes. The limits for each are as follows:

- Alcohol: One bottle that is not over 1L and $400 USD

- Perfume: 60ml

- Cigarettes: 200 cigarettes

Q: What if I exceed the duty-free purchase limit?

A: If the total of goods purchased overseas or at duty-free shops (departure, arrival, duty free shops) exceeds $800 USD, the amount in excess of the duty-free limit of $800 USD will be taxed.

Q: Do I need to declare items that exceed the duty-free limit?

Yes. If you bring in items that exceed the duty-free limit, 30% of the standard duty will be reduced if you voluntarily declare it. However, if you are caught not declaring it, you will be penalized according to the Customs Act. (ex. 50% more than general tax, additional 60% penalty if caught twice or more within 2 years)

2. Immediate Tax Refund

There are stores in Korea that provide immediate tax refunds! If you see any of these logos at a shop, that means you can get an immediate tax refund.

Q: What is the purchase limit at tax-free stores?

A: You must purchase a minimum of 15,000 KRW in a single payment to be eligible for a tax refund. The maximum amount is 1,000,000 KRW. You are also only eligible if you've spent under 5,000,000 KRW during your entire trip.

Q: How can I get an immediate tax refund?

A: Before shopping, check whether the store is an official VAT refund merchant! (These include marts, shopping malls, department stores, etc.) After purchasing items within the limit, you can pay the duty-free price by presenting your passport to the cashier. Alternatively, after paying the price inclusive of tax, you can receive a tax refund at the information desk.

Q: What if I exceed the limited amount?

A: If you have paid more than 1,000,000 KRW or purchased more than 5,000,000 KRW after entering Korea, you must go to the airport to get your tax refund.

Q: Who is eligible for immediate tax refunds?

A: 1) Foreigners that spend less than 6 months in Korea.

2) Overseas Koreans that have been living abroad for more than 2 years or living in Korea for less than three months.

3) Those who do not pay Korean taxes.

Planning on visiting cities outside of Seoul, such as Busan or Jeonju? Get a package deal for KTX and AREX train tickets here!

3. How to Receive Tax Refunds at the Airport

1) Make sure you have all the requirements needed for a tax refund.

- If you've purchased items at a Tax-Free store, present your passport to the store staff, and request a tax refund form or tax refund slip.

- Be sure to keep the tax refund form, receipt, purchased items (unopened & unused) until departure from South Korea. Your purchase must be made within 3 months of your departure date to be eligible for a tax refund.

- Travelers who want to apply for a VAT refund at the departure airport are advised to arrive well in time in case the airport is crowded.

2) Head to the check-in area and check your luggage.

![Illustrated image showing travelers at an airport check-in counter, highlighting the registration process for flights.]() Check in at the airline counter and get your boarding pass. You must be carrying the items that you are claiming for a VAT refund and the related documents, they should not be in your checked baggage.

Check in at the airline counter and get your boarding pass. You must be carrying the items that you are claiming for a VAT refund and the related documents, they should not be in your checked baggage.- If you wish to check in items as checked baggage, please inform the airline staff that there are items that are eligible for VAT refund in your checked baggage at check-in. You can attach a tag to your luggage for customs verification, then visit the customs declaration desk. There is a place to drop off your luggage at the customs check point.

3) If the total tax refund amount is under 75,000 KRW, you can use the self-service tax refund kiosk at the airport terminal.

- Select a language at the kiosk, scan your passport, and receive your refund slip.

- Check if the item needs to be checked by customs. If a customs check is not required, you can collect your refund in cash after going through security.

- The kiosks in general areas only scan receipts. Cash refunds can only be collected directly from duty-free kiosk machines or refund counters after going through security.

- In most cases, refunds are processed via the kiosk, but there are rare cases when you may be subject to customs inspection under certain conditions or random selection. If you are selected for inspection, present your passport, relevant items, receipt, and tax refund form at the customs declaration counter, and then receive a customs export confirmation stamp.

4) If the total tax refund amount is over 75,000 KRW, you'll need to head to the airport customs inspection area to get your refund.

- Items with a refund amount of 75,000 KRW or more and items that are carried by travelers with a Korean passport who have lived abroad for 2 years or more are subject to mandatory customs checks.

- Alternatively, you can receive a refund after customs inspection even if the receipt was previously scanned by a kiosk and found to be subject to customs inspection.

- Bring your passport, purchased items (unopened & unused), receipts, and VAT refund documents to the customs counter. After they are checked, you will get a stamp of export confirmation on the VAT refund documents.

- You can visit the VAT refund counter, submit the VAT refund document stamped with the customs confirmation stamp, and collect cash immediately on the spot. If you arrive outside the operating hours of the tax refund counter, please submit the relevant documents to the refund mailbox after receiving the customs confirmation stamp. After a period of time, the refund will be credited to your money order.

You'll need a SIM card and a transportation card to get around Korea easily; get the airport package to pick up both at once as soon as you land at the airport!

4. Incheon Airport Tax Refund Locations

*Please keep in mind that the Incheon Airport Tax Refund locations are subject to change. Please check the official Incheon Airport site before you visit for confirmation.

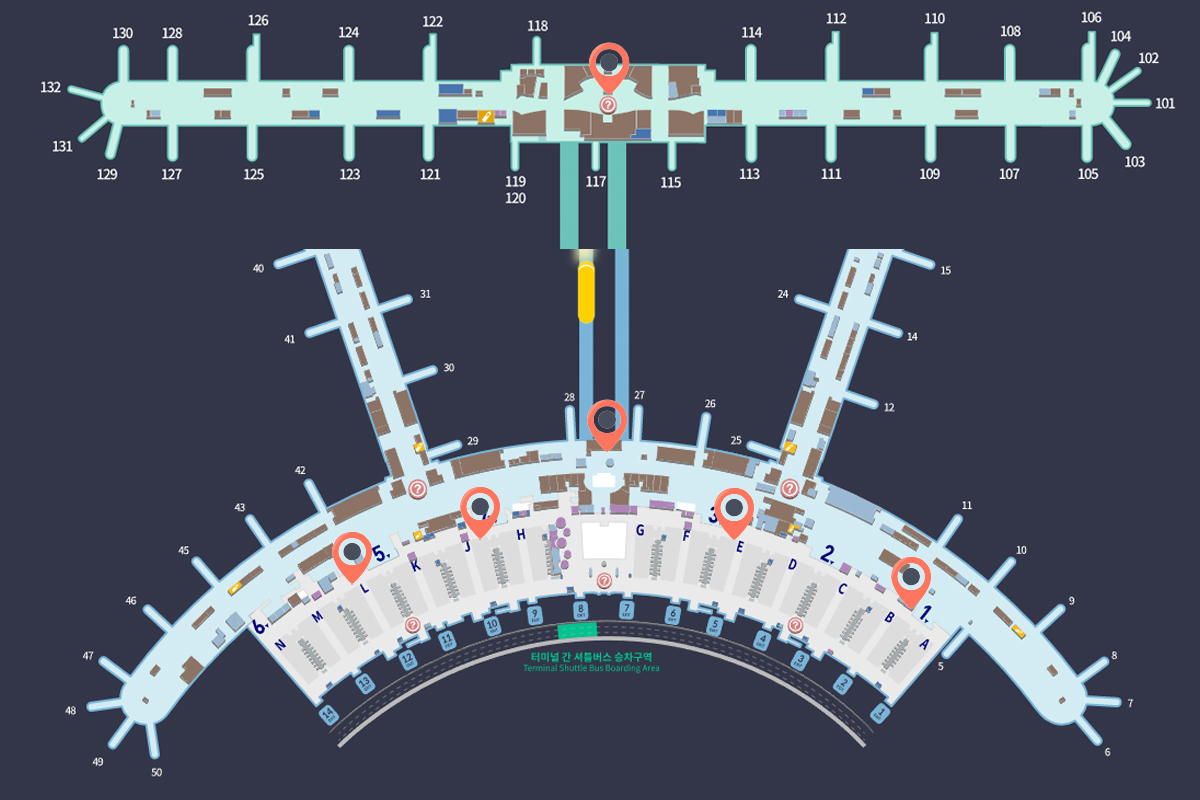

Incheon Airport Terminal 1, 3F

Location: Near Gate 28 in the duty-free area, near B and E in the east general area, near J and L in the west general area, in the center of the 3rd floor concourse. A kiosk is located in the general area near the check-in area, and you can check whether the kiosk is subject to customs declaration by scanning the refund slip and passport.

If the item is over 75,000 KRW or is marked as subject to customs check in kiosk, go to the customs declaration counter opposite or right next to it. If you have luggage that needs to be declared for customs, you can check in the luggage here after checking customs.

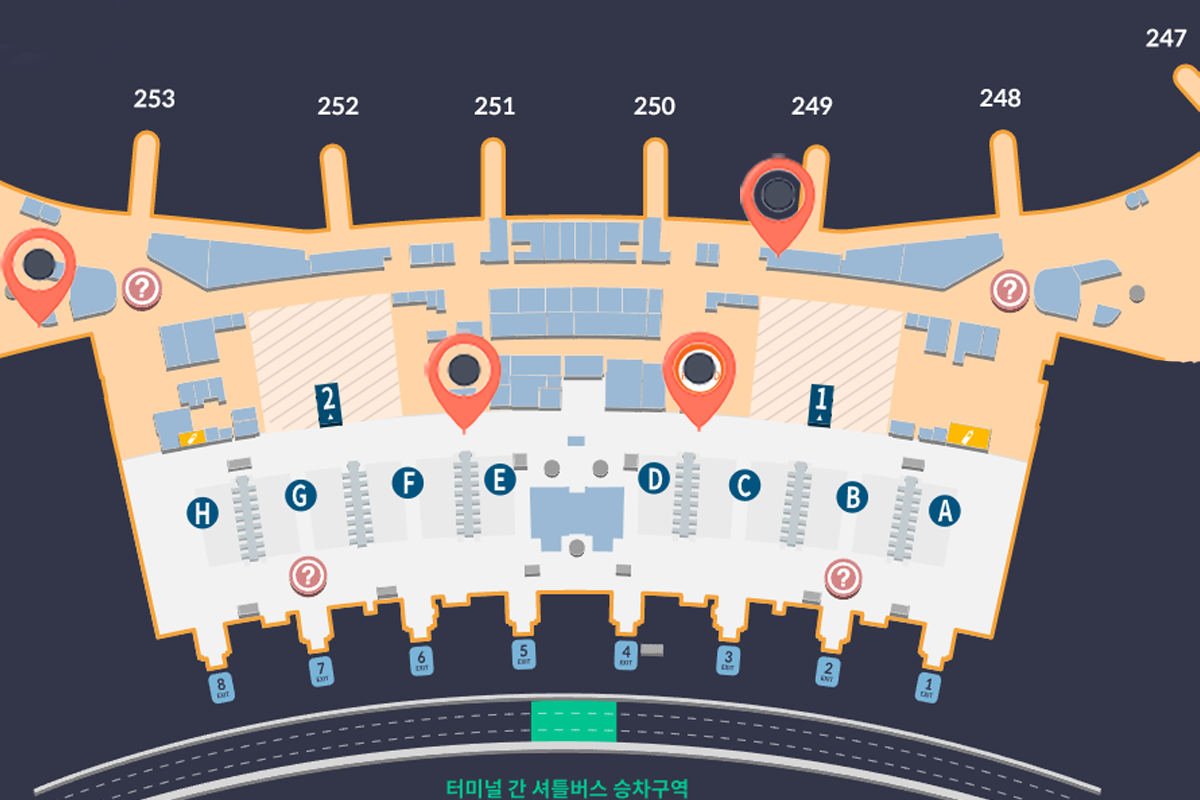

Incheon Airport Terminal 2, 3F

Location: Near check-in D and E, near gates 250, 249, 253, in the duty free area. Kiosk is located in the general are near the check in area. check if the kiosk is subject to customs declaration. If the item is over 75,000 KRW or is marked as subject to customs check in, go to the customs declaration area opposite. You can check in your luggage there.

After your security check, you can collect cash in the lounge opposite Gate 249.

5. How to Get Tax Refunds in the City

City tax refunds mainly exist in major tourist areas and require a credit card for guarantee. If you paid in cash, you can get a cash refund on the spot, but the tax refund amount will be temporarily paid by the credit card. Don't worry, it is a tax refund guarantee, so it automatically, will get refunded once verified.

- After purchasing items at a tax-free store, you will receive a tax refund slip (it is the same thing as a refund document).

- Bring your passport, refund slip, and credit card to collect refunds at a manned tax refund office or unmanned tax refund kiosks in the city.

- Global Tax Free only refunds slips with a purchase amount between 15,000 KRW and 6,000,000 KRW can be refunded.

- The refund amount limit for Global Blue is 390,000 KRW in certain parts of the city.

- Proof of a tax refund must be presented at the airport. (When leaving the country, present the purchased items, tax refund documents, and passport to customs for confirmation.)

- A credit card is required as a guarantee for your tax refund.

- You must leave Korea within 3 weeks of receiving your tax refund. It is important to note that only items purchased from affiliated stores of each company can be refund at other tax refund windows other than airports or ports. (ex. After purchasing goods at a global tax free affiliate store, a refund is possible at the global tax free city refund counter)

- Again, the amount paid will be refunded only after verification is complete. Do not throw away the proof of tax refund because you will need to present it at the airport.

6. FAQ

1) Where are the tax refund locations at other airports?

Gimpo Airport: Gates 1, 2, & 3, on the 2nd floor in front of Lotte Duty Free shop on the 2nd floor.

Gimhae Airport: Counter B26 on the 2nd floor

Jeju Airport: Gate 5 on the 3rd floor

2) Where are the refund locations in the city?

There are many tax-refund areas all over the city and even in the subway stations. If you shop at a tax-free department store, the best way to check is to see if there is a refund desk inside the department store.

3) How much in tax refunds can I get?

The refund amount will be calculated based on the amount spent, VAT, and the service charge of the refund agency applicable to the purchase. Therefore, most of the VAT in Korea is 10%, but if the service charge of the refund agency is deducted from this, you will be able to get a refund of about 4-7%.

Service charges may be calculated differently depending on the refund agency, goods, or the amount of foods, so it is recommended to check the exact refund amount at the refund window. Here are some examples listed below:

Global Tax Free

Purchase Amount | Refund Amount |

₩30,000-₩49,999 | ₩2,000 |

₩50,000-74,999 | ₩3,000 |

₩75,000-₩99,999 | ₩5,000 |

₩100,000-₩124,999 | ₩7,000 |

₩125,000-₩149,999 | ₩8,000 |

₩150,000-₩174,999 | ₩9,000 |

₩175,000-₩199,999 | ₩10,000 |

₩200,000-₩224,999 | ₩12,000 |

Global Blue

| Purchase Amount | Refund Amount |

| ₩30,000-₩49,999 | ₩1,500 |

| ₩50,000-₩74,999 | ₩3,500 |

| ₩75,000-₩99,999 | ₩5,000 |

| ₩100,000-₩124,999 | ₩6,500 |

| ₩125,000-₩149,999 | ₩8,000 |

| ₩150,000-₩174,999 | ₩9,500 |

| ₩175,000-₩199,999 | ₩11,000 |

| ₩200,000-₩224,999 | ₩12,500 |

Easy Tax Refund

| Purchase Amount | Refund Amount |

| ₩30,000-₩49,999 | ₩2,000 |

| ₩50,000-₩74,999 | ₩3,000 |

| ₩75,000-₩99,999 | ₩5,000 |

| ₩100,000-₩124,999 | ₩6,000 |

| ₩125,000-₩149,999 | ₩8,000 |

| ₩150,000-₩174,999 | ₩9,000 |

| ₩175,000-₩199,999 | ₩10,000 |

| ₩200,000-₩224,999 | ₩12,000 |

4) How can I get a refund?

If you receive payment in cash, you will be able to get a refund in your own country's currency as it is not only paid in just Korean currency. However in the case of non-Korean currency, the refund amount may be smaller in the process of being converted to another national currency.

Refund agencies process refunds not only in cash, but also in other various payment methods.

Global Blue: Alipay, Paypal, Mastercard, Unionpay, VISA, American Express, Bank Transfer, JCB

Global Tax Free: Cash, Cards issues outside Korea (VISA, Mastercard, JCB, Unionpay) Alipay, WeChat, QQ, etc.

Trendy Activities to Enjoy in Korea

We hope that this information was helpful for your tax refunds in Korea! Please leave a comment below or send us an email at help@creatrip.com if you have any questions or concerns. Also make sure to follow us on Instagram, TikTok, Twitter, and Facebook to stay updated on all things Korea!